POWER Magazine – Enapter Makes Headway on AEM Electrolyzer Mass Production

Enapter, a German manufacturer of Anion Exchange Membrane (AEM) electrolyzers, is gearing up to deploy an automated production line to scale up electrolyzer manufacturing and ramp up green hydrogen production

The company on June 14 said that after “months of preparation,” it is readying to kick off construction of its “Enapter Campus” in Saerbeck, Germany, this fall. The mass-production and research and development (R&D) site will “turn cost-reduction potential into reality and bring global hydrogen generation targets within reach,” it said.

The company on Monday also reported the campus will be backed with €9.3 million ($11.1 million) in funding from the North Rhine-Westphalia (NRW) Ministry of Economic Affairs, Innovation, Digitalisation, and Energy. In a November 2020-issued “hydrogen roadmap,” the state in western Germany—a region that generates and consumes around 30% of the nation’s power—projected 250 TWh to 800 TWh will be needed per year in Germany to meet demand from energy-intensive industries and the transportation sector.

While the region today hosts nearly half of Germany’s lignite mining operations, with Germany’s coal phaseout slated for 2038, and Germany’s recent move to shift net-zero targets up to 2045, NRW wants to position itself as a hydrogen economic powerhouse. Its recent roadmap, notably, calls for the quick and cost-effective establishment of hydrogen infrastructure and a market ramp-up of hydrogen technologies.

Among NRW’s many targets set for 2025, the state wants to host 120 kilometers (km) of Germany’s planned 500 km of hydrogen pipelines that would be connected to the nation’s first “supra-regional” hydrogen lines. It also wants to establish electrolysis plants within the state of a total capacity of 100 MW for industrial hydrogen production by 2025—and expand these to up to 3 GW by 2030.

Dramatic Production Scale-up

Today, Enapter currently produces 100 electrolyzers based on its innovative AEM technology (see sidebar, “What is Anion Exchange Membrane Electrolysis?”) in Crespina, Italy; it is looking to ramp up production to 400 electrolyzers at that facility by the end of the year. The mass-production facility in Saerbeck, however, is slated to dramatically boost production, Sebastian-Justus Schmidt, chairman of Enapter AG, told POWER on Monday. “The automated mass production possible with our standardized AEM electrolyzers will make green hydrogen affordable, accessible, and scalable,” he said. “In Saerbeck, we are aiming to achieve a production capacity of 10,000 units per month at full capacity.”

What is Anion Exchange Membrane (AEM) Electrolysis?

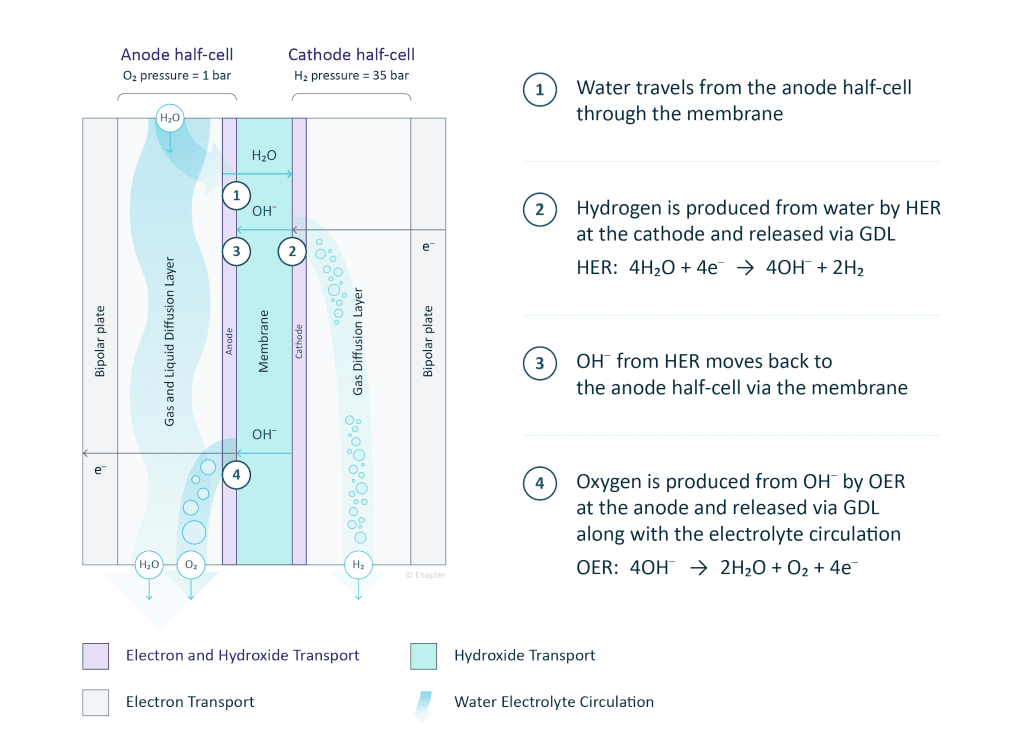

Interest in electrolytic hydrogen has ramped up of late, owing to solar PV and wind’s declining costs and widespread uptake, and larger projects have been installed and announced over the last five years. While electrolyzers essentially use electricity to split water (H₂O) into hydrogen (H₂) and oxygen (O₂) through an electrochemical reaction, today, three main electrolyzer technologies dominate the scene: alkaline electrolysis, proton exchange membrane (PEM) electrolysis, and solid oxide electrolysis cells (SOECs). Enapter, which offers a “standardized and stackable” anion exchange membrane (AEM) electrolyzer as its core product, explains that its stack —the “electrolyzer’s heart”—comprises “multiple cells connected in series in a bipolar design.” Its cells consist of a membrane electrode assembly (MEA) that is made from a “polymeric AEM and specially designed low-cost electrodes.” Oxygen is evolved from the anodic side and transported out from the stack through the circulating electrolyte. “Using AEM water electrolysis, Enapter’s modular electrolyzers can produce 500 NL of green hydrogen per hour, with a purity of 99.9 % (99.999 % after drying) at 35 bar pressure from 0.4 liters of water and 2.4 kWh of renewable energy,” it says.

|

As shown in the diagram above, the single cell in an AEM electrolyzer is separated into two half-cells by the anion exchange membrane. Each half-cell consists of an electrode, a gas diffusion layer (GDL), and a bipolar plate (BPP). Multiple single cells are connected by the bipolar plate to form the AEM stack. Enapter provides a more detailed explanation here. Courtesy: EnapterAccording to Hoon Chung, a staff scientist at Los Alamos National Laboratory, AEM may achieve high performance without feeding any salt or alkaline solutions to its electrodes. And, because it eliminates most expensive PEM electrolyzer components—including platinum and iridium as catalysts—it could offer a more than 75% stack cost reduction.

At the Saerbeck mass-production facility, Enapter plans to leverage efficiency improvements gleaned from its Crespina process “in all steps involved,” Schmidt said. “With the mass production, we are aiming to automate many production steps from chemical production to cell and stack assembly and electrolyzer assembly.” Compared to the Crespina process, where electrolyzers are today assembled in serial production in Italy, taking “a few hours” to build devices, at Saerbeck, Enapter is “aiming to be able to produce one electrolyzer every 4 minutes,” he said.

The manufacturing process essentially has four distinct parts: chemical production for stack components; stack assembly, electrolyzer assembly, and testing/quality control, he explained. “During chemical production, we start from raw materials and perform all required chemical synthesis in-house. We make our own catalysts and electrodes, manufacture our unique MEA (membrane-electrode assembly) combined with gas diffusion layers, and use low-cost steel and plastic components to form the cells and ultimately the electrolyzer stack,” he said.

However, this is “currently done with manual labor,” Schmidt said. “Obviously, a maximum degree of automation is required for mass production. We are working towards realizing an automatic stack assembly characterized by pick-and-place robots, automatic visual fault detection, and minimal demands on human operators.” Ultimately, Enapter wants to combine various pre-assemblies—including the electronic compartment, water tank, gas piping, heat exchanger, and stack—via a “high degree of automation as well,” Schmidt said.

As well as producing larger volumes of electrolyzers, another important goal is to drive down electrolyzer costs—which could, in turn, tamp down the cost of its produced green hydrogen. Since Enapter launched its first AEM model in 2018, the company says it achieved a 40% device cost reduction by 2019 and a further 20% by 2020. While the 2.4-kW EL 2.1 unit today retails at €9,000 ($10,735, not including the added option of a dryer), Enapter is looking to achieve a short-term cost reduction of 70% (to €2,500) and even 90% over the medium term for the AEM Multicore. That’s what it will take to “replace fossil fuels with green hydrogen,” said Schmidt.

Written by Sonal Patel

Original article here.